As a first bank in Estonia, we launched an electronic banking platform for electronic sign-ups in December enabling new clients to open an online bank account in just a few minutes. You don’t have to visit a bank office any more, identifying yourself with Mobile-ID or an ID card is quite enough. You can use your online bank immediately after registering and the bank card will be sent to you at your home address by post.

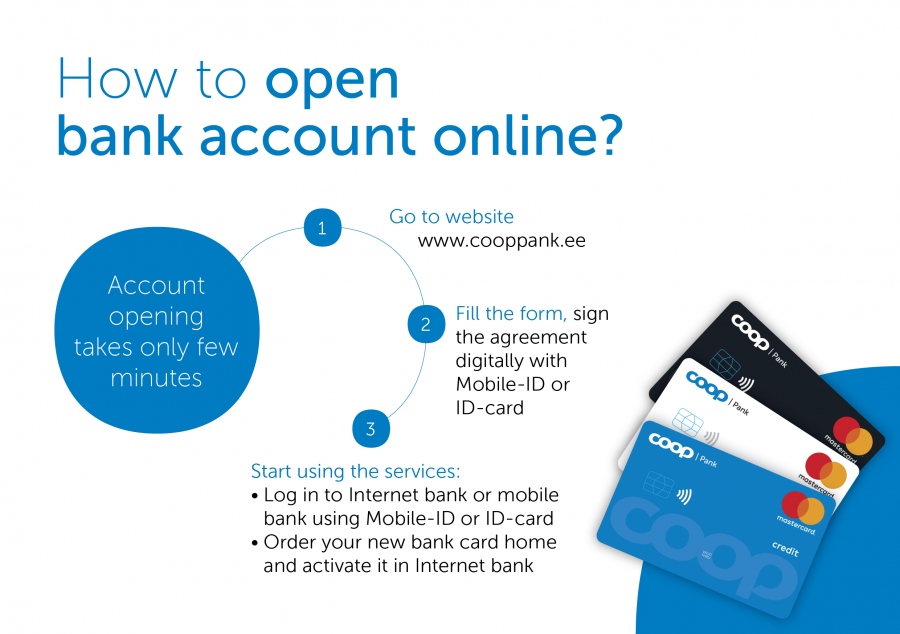

To open a bank account, identify yourself on Coop Pank homepage with an ID card or Mobile-ID, choose a suitable banking plan, fill in the client form and sign the contract. If you wish to have a bank card, we will send it to you via post within a week. You will immediately get an access to the online and mobile bank of Coop Pank.

Switching banks or joining a new bank has never before been so easy or prompt for private persons. “Joining Coop Pank only takes a few minutes and does not depend on time of the day or day of the week,” said Margus Rink, Board Manager of Coop Pank.

So far, banks have not been able to provide a similar solution due to statutory rules requiring identification of a person opening a bank account face to face or via video bridge. The legislative amendment implemented at the end of last month alleviated the identification requirements of private persons for banks: identification with and ID card or Mobile-ID is now enough for execution of everyday bank operations.

Online clients can make payments up to EUR 15,000 per month (transfers via online banking up to EUR 10,000 and up to EUR 5000 in card payments). If you need the transaction limits to be higher, take your identification document with you and visit us at any of the 14 Coop Pank offices. Legal persons need to visit our bank office in order to open an account and sign the contract.

At Coop stores (Konsum, A ja O, Maksimarket), Coop Pank bank cards work similarly to Säästukaart by providing different benefits and collecting bonus points. Clients who have joined Coop Pank banking plan can withdraw cash with their bank cards from ATMs of any other banks without extra charge. As of next spring, Coop Pank plans to launch cash payout service for it's customers from cash registers of all Coop stores in Estonia.

Come to Coop:

- Open a bank account via Internet or let us know by visiting us at any of our bank offices all over Estonia, calling our client support at 660 0966 or visiting banking points in Coop Eesti stores.

- Internet enables you to open a bank account in a few minutes by identifying yourself with and ID card or via Mobile-ID. You can start using the online bank immediately after filling the application and you don’t have to visit a bank office.

- We will send your bank card to your home address within a week by post. Now you can carry out your everyday bank operations at Coop Pank.