Invest in a fast-growing Estonian bank

Offering of Coop Pank shares has ended

Coop Pank is here to stay. Our mission is to boost Estonian companies and help people make their dreams come true in every corner of Estonia – in the countryside as well as in the cities.

Invest in your own future and in the future of Estonia by subscribing for the shares of the rapidly growing Coop Pank.

For five years in a row, Coop Pank has grown its business volumes by nearly 40% per year

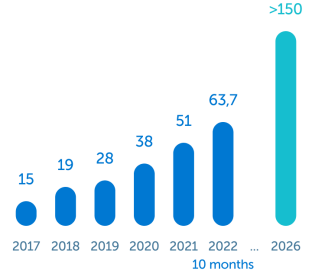

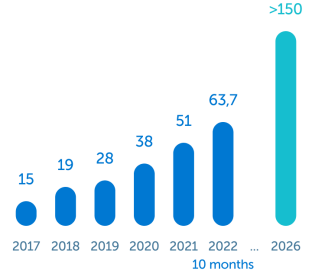

Growth in the number of clients

+31% per year

Growth in deposits

+34% per year

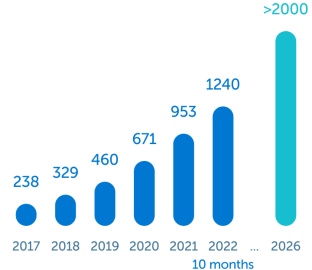

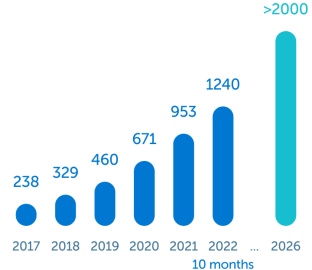

Growth in loan portfolio

+44% per year

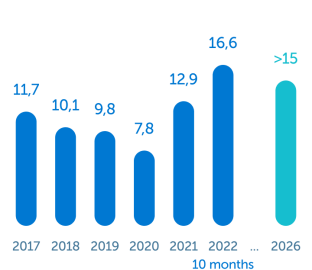

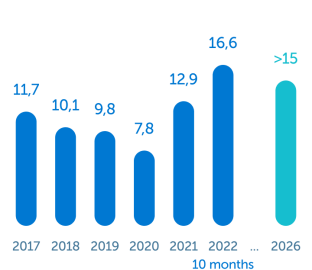

Growth in net profit

+51% per year

Coop Pank's growth goals by the end of 2026

Number of active

clients 24% per year on average

Loan portfolio

16% per year on average

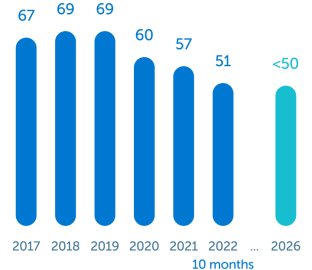

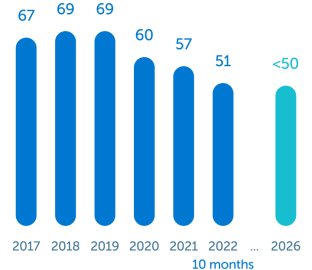

Cost/income ratio

Return on equity (ROE)

Number of active

clients 24% per year on average

Number of active

clients 24% per year on average

Loan portfolio

16% per year on average

Loan portfolio

16% per year on average

Cost/income ratio

Cost/income ratio

Return on equity (ROE)

Return on equity (ROE)

Subscribe for the shares of rapidly growing Coop Pank

Subscribing for Coop Pank shares is very easy:

- Firstly, indicate whether you have a securities account or not. If you’re not sure whether you have a securities account, you can check it here .

- Secondly, choose the bank where you would like to open a securities account and subscribe for the shares.

In which bank your securities account is in?

Since Coop Pank itself doesn’t provide investment services, it’s not possible to open a securities account or subscribe for shares in Coop Pank.

Secondary public offering of Coop Pank shares

Issue volume

15-20 € million

Share price

€ 2,00

The subscription period lasts from

15.-29.11.2022

Key dates of the offering

-

Subscription

Starts on 15. November 2022 at 10:00

Ends on 29. November 2022 at 16:00The shares are offered publicly to retail investors in Estonia and privately to professional investors. Please see the prospectus for a more detailed description.

-

Distribution

The Bank will decide on the distribution of the shares after the end of the offering period on or about 30 November 2022 and will publish the results of the offering on or about 01 December 2022. Please see the prospectus for a more detailed description of the distribution principles.

-

Settlement and admission to trading

The shares distributed to investors will be transferred to their securities accounts on or about 05. December 2022. Trading with the bank’s new shares in the main list of Nasdaq Tallinn Stock Exchange is expected to begin on or about 07. December 2022.

Prospectus of the secondary public offering of shares of Coop Pank

The prospectus has been published in accordance with the requirements of EU Regulation 2017/1129/EU and is available on the websites of the Financial Supervision Authority and Coop Pank at www.fi.ee or www.cooppank.ee/pakkumine.

In which bank your securities account is in?

Question/answer

The secondary public offering of Coop Pank shares will take place from 15 to 29 November 2022. You need a securities account to subscribe for the shares. The shares of Coop Pank can be subscribed for via all banks that manage Baltic securities accounts. The biggest banks among them are: LHV Pank, Swedbank, SEB Pank and Luminor.

You can use the channels made available by the account manager to submit the subscription application. The easiest way to subscribe for the shares is via an Internet bank.

The instructions on how to open a securities account required for subscribing for the shares open in a separate window after you’ve selected your home bank where you want to open a securities account.

The shares are offered publicly only to Estonian retail investors and non-publicly to qualified investors in certain selected Member States of the European Economic Area. Please see the prospectus for details.

A legal person needs an LEI code to buy shares. Companies and other legal entities can apply for an LEI code from authorised agencies, a list of which can be found on the website of the Global Legal Entity Identifier Foundation (GLEIF).

Coop Pank will offer up to 7,610,348 new ordinary shares without nominal value, with the right to increase the number of shares in the offering by up to 2,536,783 shares in the event of oversubscription, bringing the total number of shares in the offering up to 10,147,131 shares.

The subscription price of a Coop Pank share is €2,00 per one offer share. Please see the prospectus for details.

Yes, according to the Commercial Code, when the share capital is increased and new shares are issued, a shareholder of the bank has the pre-emptive right to subscribe for new shares in proportion to the book value of their shares. The list of shareholders with pre-emptive rights is fixed in the settlement system of the Estonian Register of Securities as at EOD on 15 November 2022.

In the case of oversubscription, the shares will be distributed on the basis of all subscription applications. First, the bank will satisfy the subscription orders of the shareholders with the right of preemption. The bank also has the right to prefer the bank’s shareholders in respect of the part that exceeds the pre-emptive subscription rights, and the bank also has the right to prefer its clients and the persons who have invested in the bonds issued by the bank. Detailed information on the distribution of the offer shares can be found in the prospectus.

The results and distribution of the issue will become clear on or about 01.12.2022. After the distribution of the shares, every subscriber can receive information on the number of the Coop Pank shares held by them in the bank where they opened a securities account and through which they subscribed for the shares of Coop Pank.

For more information, please visit the website www.cooppank.ee/pakkumine or read the prospectus .