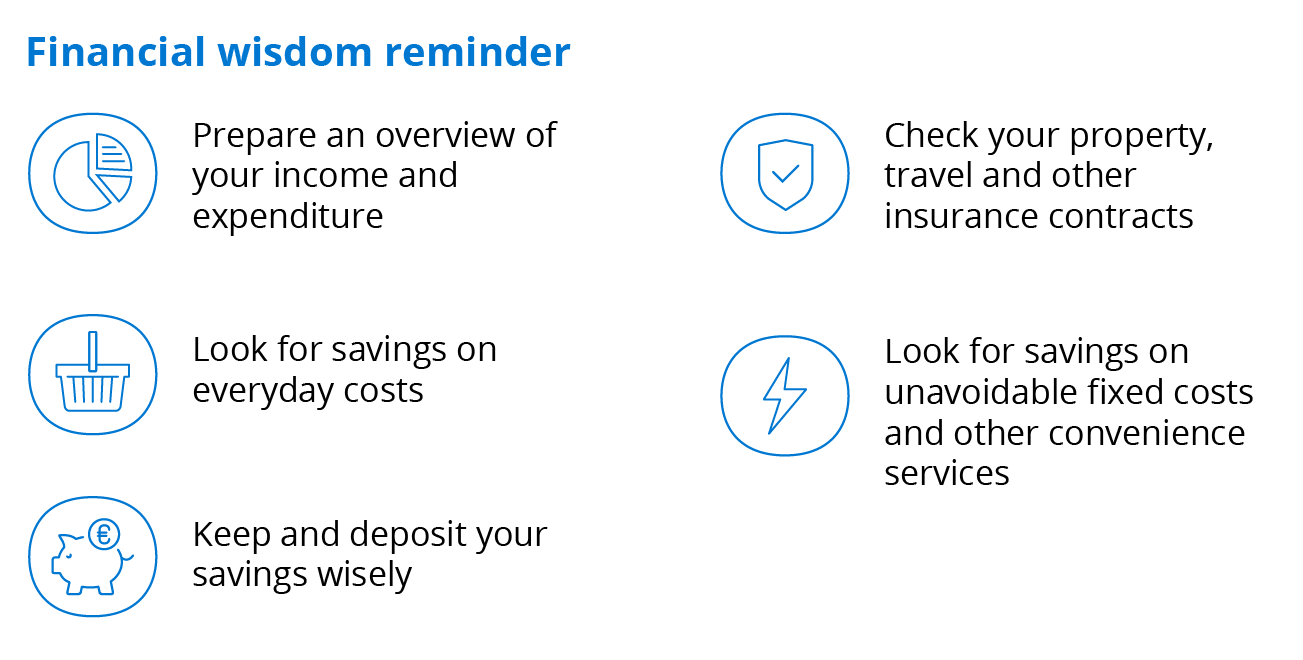

In order to save, you first need to get a detailed overview of what you spend your money on. Start by writing down all your daily expenses for a month: every visit to the shops or café, every bus ticket and taxi fare, a gift for a friend, all clothes bought. This will give you an overview of where your money actually goes and where you could find options for saving.

According to Statistics Estonia, the food and not alcoholic beverages comprise the biggest share of household expenditure. Choosing what you put in your shopping trolley is an option, but using the loyalty card of your home shop will definitely help you save money. Using a Coop Pank bankcard is certainly the best thing for you as a client of Coop, as it gives you the best prices at all 330 Coop stores and savings on bank charges. Coop Pank offers both payments and a bankcard free of charge to clients aged 55 and older.

In addition, the bankcard of Coop Pank also helps you save on fees associated with cash deposits and withdrawals. Namely, you can withdraw and deposit cash free of charge with your Coop Pank card at the checkouts of all Coop stores, and you can also withdraw cash free of charge from ATMs of all other banks in Estonia and across Europe, regardless of the logo on the ATM.

Once your running costs are under control, it’s worth reviewing and writing down all the unavoidable fixed costs of housing: mortgage and lease payments, energy bills, communication costs, insurance premiums. When mapping your costs, it’s worth taking a look at the content of these contracts at least once a year as well. Make sure you’re using all the channels you subscribe to in your TV package, or cancelling some would help cut costs. Did you know that insurance policies taken out for a longer term are often cheaper than shorter ones? For example, Coop Pank offers its clients with banking plans low-cost travel insurance with a standing order for a whole year. Coop Pank also automatically insures all durable goods purchased by private individuals with debit and credit cards that cost from €100 to €2,500 (the maximum amount of purchase insurance for electronics is €500). You can use free mobile apps, Excel, or even a pen and paper to keep track of your expenses and budget. By writing down all the costs and preparing your monthly budget, you can be sure that you’ll find options for saving money you haven’t even thought about so far.

When it comes to maintaining and growing your savings buffer, it’s equally important to keep track of whether you are paying for depositing your money or earning from it. For example, Coop Bank pays the users of its Rändrahn plan interest at the rate of 1% per year on the monthly balance of the account, calculated on the basis of the daily balance. This means that the average amount deposited in your account all year round is ca €5,000, Coop Pank will pay you ca €50 a year for this. The big advantage of this is that the money in the account is always available and usable by the account holder.

Also, Coop Pank recently increased its interest rates on fixed-term deposits, which can now be up to 3% for longer deposit periods. “A fixed-term deposit is suitable for people who want to make their savings earn extra money without taking excessive risks,” said Teet Kerem, Head of Everyday Banking at Coop Pank.

He added that a fixed-term deposit is the safest way to grow money, as the national Guarantee Fund guarantees deposits, with the interest earned, to the extent of up to €100,000 per depositor in one credit institution.