Time is money – start saving today

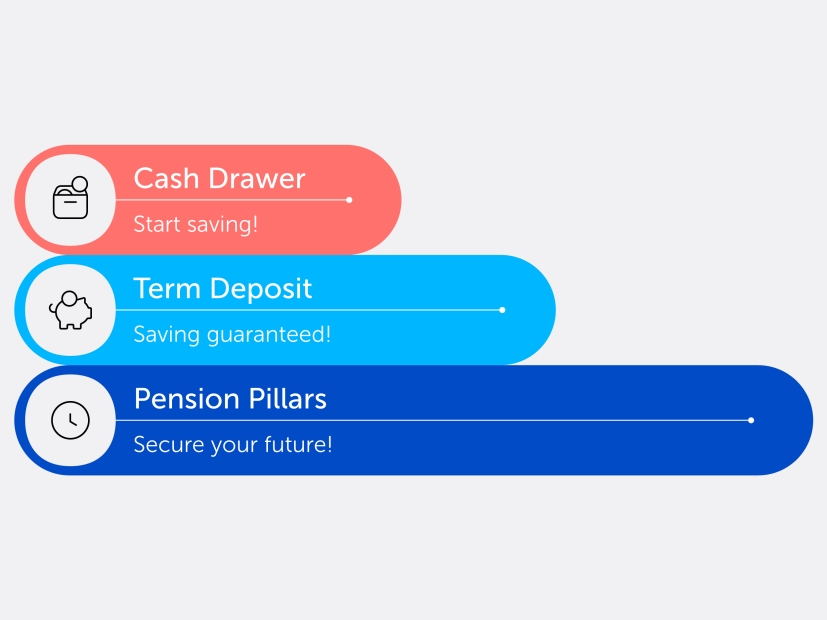

As a local bank, we want Estonia to be the best place to live, now and in the future. This is why we’re your partner in money matters, so you can focus on with what really makes you happy. We’ve created a versatile savings solution that helps you to meet both your practical needs today and your long-term dreams through convenient savings and smart investments.

Saving can mean putting money aside every day as well as a long-term investment that secures your more distant future. It doesn’t matter whether your time horizon is short or stretches over decades, saving money helps you to achieve your goals. The most important thing is to start today.